Introduction to Liabilities

Quick introduction to the module key capabilities

Introduction

Liabilities in eramba refer to legal and contractual obligations your organization has with third parties: SOX, GDPR, Contractual Obligation with a Supplier, etc. are common examples.

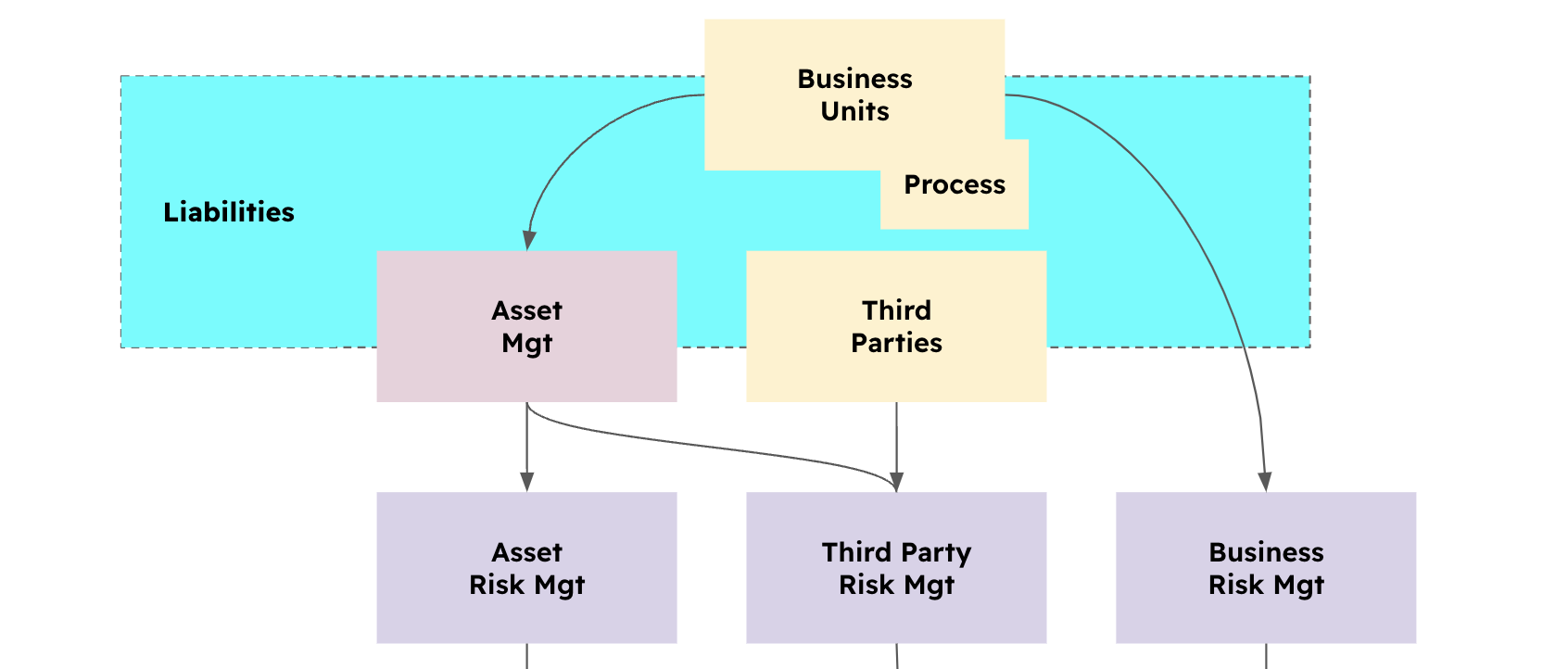

Liabilities can be linked to Business Units, Assets and Third Parties.

Each liability can have a "Risk Magnifier" numerical value (0 or higher) that will be used as a multiplier for Risks. The objective is for example to multiply by 10 all Risks that somehow are associated with Sarbanes Oxley or GDPR. The magnifier can be set to zero and then no alteration to the Risk score will take place.

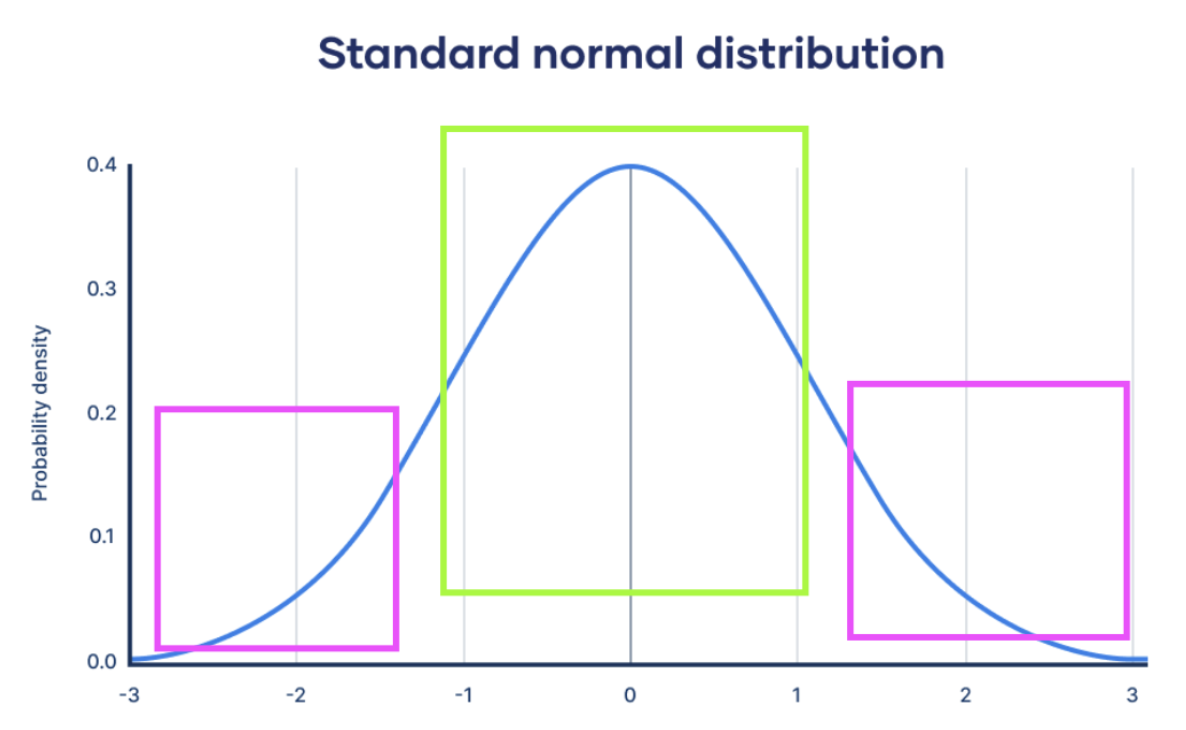

In a normal Risk Matrix risk scores are limited by their values and that tends to group Risks one with another (pink boxes), using multipliers those Risks that are serious threats to the business will be highlighted outside the normal distribution (green box).

Magnifier Value

The way you control that "Highlight" is through a magnifier value that you can (optionally) configure on the liability. This magnifier is a numerical value, For example: 0,1,300, Etc.

This value will affect the Risk Calculation (only eramba and eramba multiply calculation methods) by multiplying the original score by the summary of all liabilities linked to the Risk.

For example, the math on a Risk would look like the screenshot below, the normal risk calculation (out of likelihood and impact) is further multiplied by 10 because a liability with that magnifier is linked to the inputs of the risk (in our example an Asset)

You are not obliged to use Liabilities as they are optional and even if you use them, you can set a magnifier value of 0 and that will not affect the standard calculation.

Playlist

- Episode 1Introduction to the Asset Module10 mins left

- Episode 2Typical Asset Questions4 mins left

- Episode 3Introduction to the Business Unit Module1 min left

- Episode 4Business Unit Module Tabs1 min left

- Episode 5Creating a Business Unit1 min left

- Episode 6Creating a Processes0 mins left

- Episode 7Introduction to Liabilities1 min left

- Episode 8Introduction to Third Parties1 min left

- Episode 9Asset Module Tabs1 min left

- Episode 10Creating an Asset2 mins left

- Episode 11Reviewing Assets7 mins left